unemployment benefits tax return 2021

UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY. 24 and runs through April 18.

IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer.

. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Yes unemployment benefits received in 2021 are considered federally taxable income. Middlesex County One-Stop Career Center.

See How Long It Could Take Your 2021 State Tax Refund. Approximately 25 million people received unemployment benefits in 2021. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income.

Workers collected 325 billion in total benefits in. Tax season started Jan. E-File Your Tax Return Online.

Hudson County One-Stop Career Center - Jersey City. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Heres a look at more tax-planning news.

Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. The American Rescue Plan Act of 2021 was signed into law on March 11 2021 and excluded up to 10200 in unemployment benefits from taxes for 2020 after many.

Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. If your New York unemployment benefits have run out you may be eligible to receive extended unemployment benefits through one of the state or federal unemployment extension.

Another thing the American Rescue Plan did was exempt up to 10200 of unemployment compensation from taxes for the 2020 tax year. Ad Avoid the Frustration That Comes with Filing Your Own Taxes. Contact Our Experts Today.

Ad 4 Simple Steps to Settle Your Debt. In 2020 millions of Americans lost their jobs in the wake of the COVID-19. The IRS has sent 87 million unemployment compensation refunds so far.

If you are a New York State part-year resident you must file Form IT-203 Nonresident and Part-Year Resident Income Tax Return if you meet any of the following. Benefits are 60 of your average weekly before-tax wages during the Base Year. Gloucester County One-Stop Career Center.

Explained How To Report Unemployment On Taxes Youtube

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

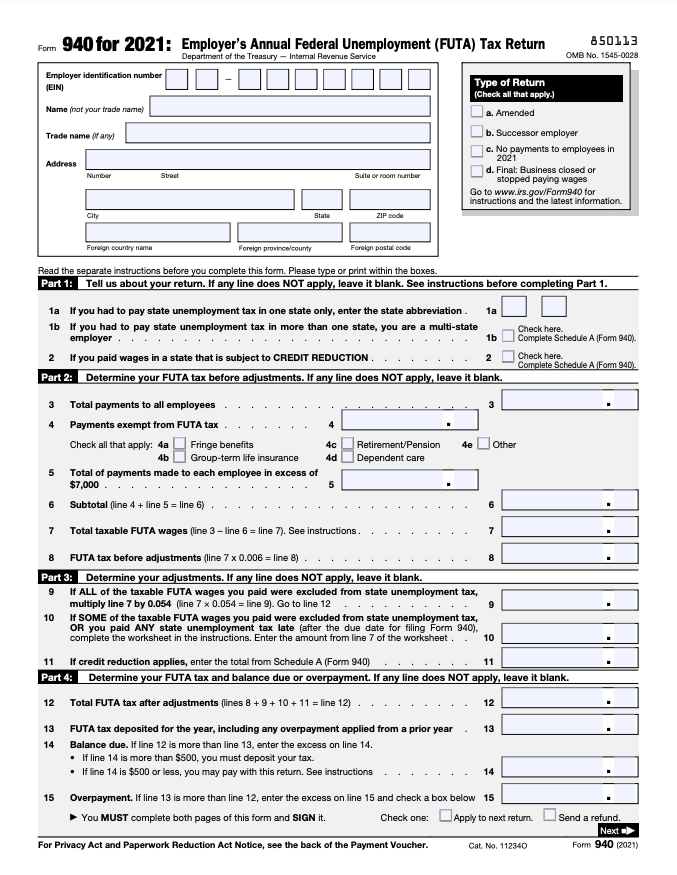

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Form 940 When And How To File Your Futa Tax Return Bench Accounting

Minnesota W4 Form 2021 W4 Tax Form Tax Forms Filing Taxes

Yes Fourth Stimulus Check Update Irs Tax Refunds 10 200 Unemployment Tax Refund Irs Taxes Checks

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

State Income Tax Returns And Unemployment Compensation

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com