unemployment tax refund update october 2021

They will go out as the IRS continues to process 2020 tax returns and recalculate returns that were already processed earlier in. Dont expect a refund for unemployment benefits.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

November 3rd 2021.

. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. This is your tax refund unemployment October 2021 update. Many filers are able to protect all or a portion of their income tax refunds by applying their bankruptcy exemptions to the expected refund.

The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start. Prepare federal and state income taxes online. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

See How Long It Could Take Your 2021 State Tax Refund. A quick update on irs unemployment tax refunds today. Christopher Zara 10272021 Travel to Hawaii during Covid-19.

The IRS has sent 87 million unemployment compensation refunds so far. In summary if you received unemployment compensation in 2020 and paid taxes the IRS was supposed to send you a refund check because it was originally supposed to be taxable but they later came back and said up to. They are still issuing those refunds.

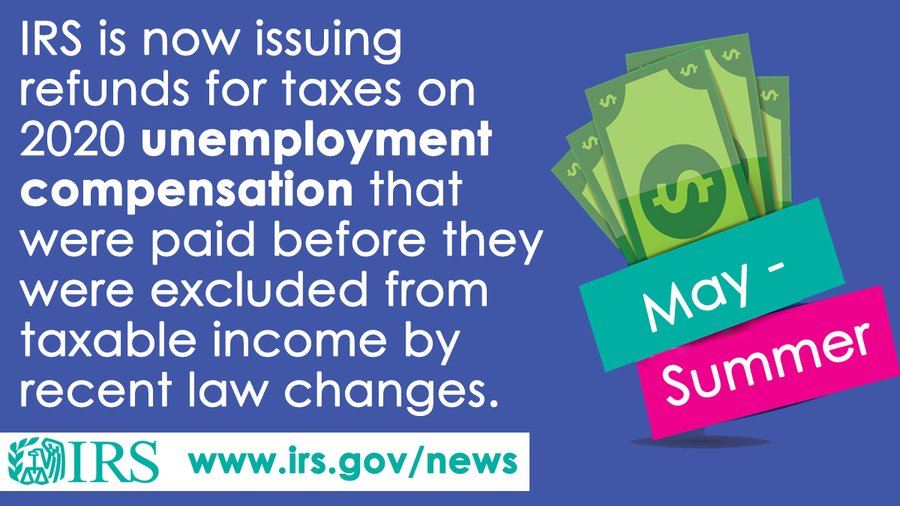

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. Unfortunately an expected income tax refund is property of the bankruptcy estate.

Are you still waiting for the IRS to return the taxes you paid on your 2020 unemployment benefits. The American Rescue Plan Act had waived federal tax on up to 10200 of benefits collected in 2020. How Did The Nazis Reduce Unemployment.

The federal tax code counts jobless benefits as taxable income. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per. The IRS just confirmed yes.

Find recent news items. 2021 tax preparation software. Most of the families who are qualified will be receiving only half of the amount for the child tax credit for the year 2021.

Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits. Ad Learn How Long It Could Take Your 2021 State Tax Refund.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. This is your tax refund unemployment October 2021 update. Thats the same data.

It is more likely that payments will be done in advance due to changes in the system of Child Tax Credit. Friday october 15 is approaching why your tax refunds are coming late. But recently the irs just announced that they are sending out refunds to 4 million people.

October 19 2021. Not the amount of. Ad Learn How To Track Your Federal Tax Refund And Find The Status Of Your Direct Deposit.

In total over 117 million refunds have been issued totaling 144 billion. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

You paid some state unemployment tax on time some late and some remains unpaid. Some of the payments are possibly related to 2020 unemployment. As of June 10 the IRS had processed more than 45 million of the more than 47 million individual paper tax returns received in 2021.

So we are now officially about to enter into the third wave of the unemployment tax refund payments. Russians brace for deadly conflict economic hardship as Putin orders. Where To File For Unemployment In Georgia.

Fourth stimulus check update today 2021 irs tax refund unemployment update. 100 Free Tax Filing. Half of the payment will be done this year and the other half will be done by 2022 in the next tax return period.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax break. By Anuradha Garg. They are still issuing those refunds.

Efile your tax return directly to the IRS. Roman Catholic Diocese of Metuchen 146 Metlars Lane Piscataway NJ 08854. They will go out as the IRS continues to process 2020 tax returns and recalculate returns that were already processed earlier in.

What you need to know before you go War is my biggest horror. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee. Report Sexual Offenses Financial Transparency Sign up for Virtus Sessions Bishops Annual Appeal.

This is your tax refund unemployment October 2021 update. October 28 2021 Taxes By Noel B. Wow Fourth Stimulus Check Update 1000 Unemployment Stimulus Check Ir In 2021 Tax Refund Good News Irs Taxes.

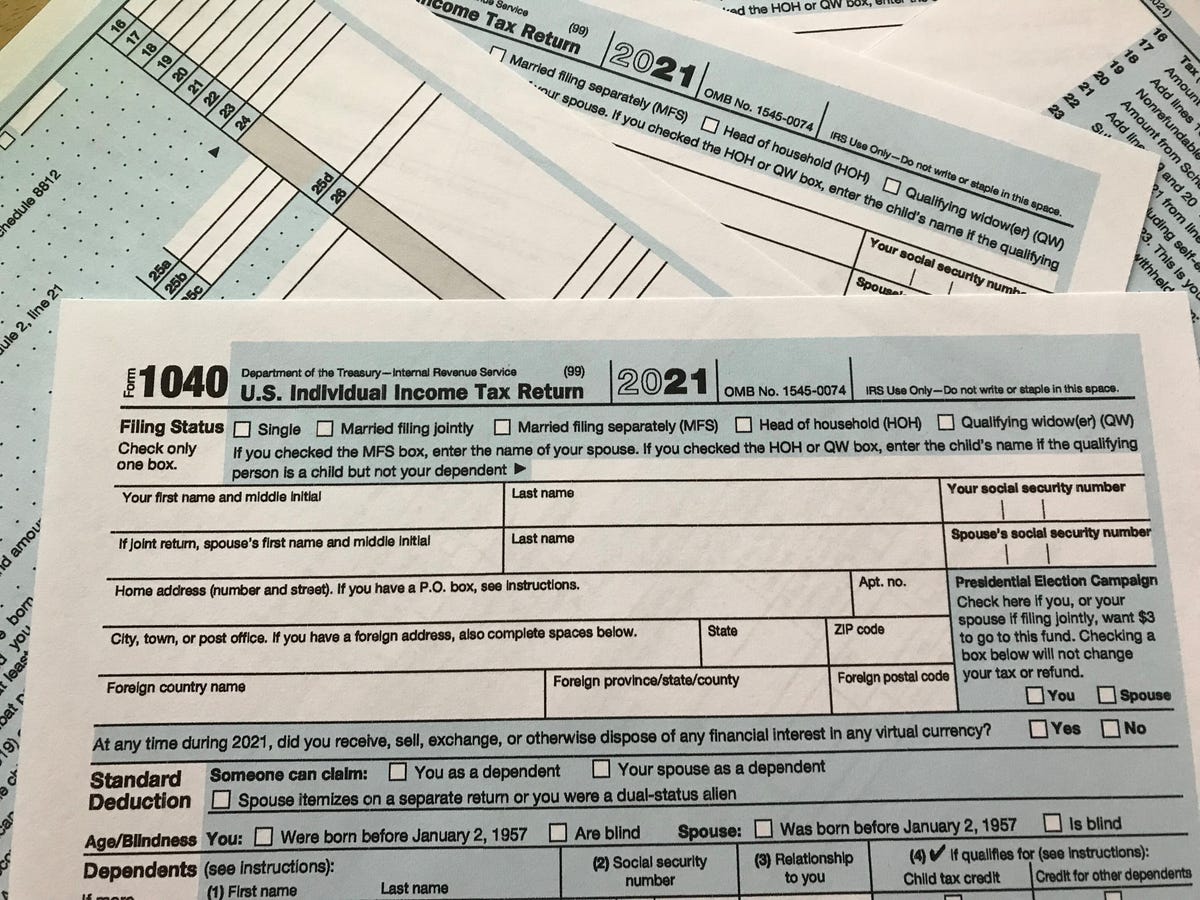

The extension date for filing personal income tax returns of October 15 2021 was unchanged. COVID-19 Teleworking Guidance Updated 08032021 The Divisions telephone based filing and inquiry systems will be down beginning Tuesday September 6 2022 for system maintenance. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income.

If so I have a quick update. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment. Generally after using all of your available exemptions the remaining unprotected amount is often little or nothing.

We expect the systems to be back online Thursday September 8th. October 12 2021. If so I have a quick update.

Check For The Latest Updates And Resources Throughout The Tax Season. 22 2022 Published 742 am.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Millions Of Taxpayers Getting Surprise Bills Revised Tax Statements From Irs Irs Taxes Tax Irs

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Equifax 418 682 Fico 9 Score Revolving Credit Low Utilization Payment History Delete Collections Credit Reporting Agencies Scores Credit Repair

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

More Of Those Surprise Tax Refunds Go Out This Week The Irs Says Will You Get One

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Quickstudy Finance Laminated Reference Guide Small Business Tax Tax Prep Checklist Business Tax

Where S My Refund Home Facebook

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Average Tax Refund Up 11 In 2021

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

The Irs Is In Crisis Taxpayer Advocate Warns Of 2022 Refund Delays

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

October 13 2021 Supply Chain News Supply Chain Long Beach Port Gas Industry

5 Companies Now Make Up 20 Of The S P 500 Here S Why Goldman Sachs Says That S A Bad Signal For Future Market Returns Future Market Goldman Sachs Marketing

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings